529 Yearly Contribution Limit 2025

Blog529 Yearly Contribution Limit 2025. When considering 529 contribution limits, remember the annual gift tax exclusion. In 2024, you can give up to.

To be eligible to receive the state contribution you must make the minimum contribution of $25, $100, or $250, based on your household income (as verified by the office of the.

Beneficiaries are allowed to roll over up to $35,000 over their lifetime into a roth ira in their name (not the original 529 account holder’s name).

529 Plan Contribution Limits (How Much Can You Contribute Every Year, The aggregate 529 contribution limit varies across states from $235,000 to greater than $550,000, with the threshold set to ensure that potential costs for higher. Each state sets its own annual contribution limit for 529 plans.

529 Plan Contribution Limits Limits on annual Royalty Free Stock, Each state sets its own annual contribution limit for 529 plans. Contributions and associated earnings that you transfer to the roth ira must.

Coverdell ESA vs. 529 Plan What’s the Difference?, When considering 529 contribution limits, remember the annual gift tax exclusion. To be eligible to receive the state contribution you must make the minimum contribution of $25, $100, or $250, based on your household income (as verified by the office of the.

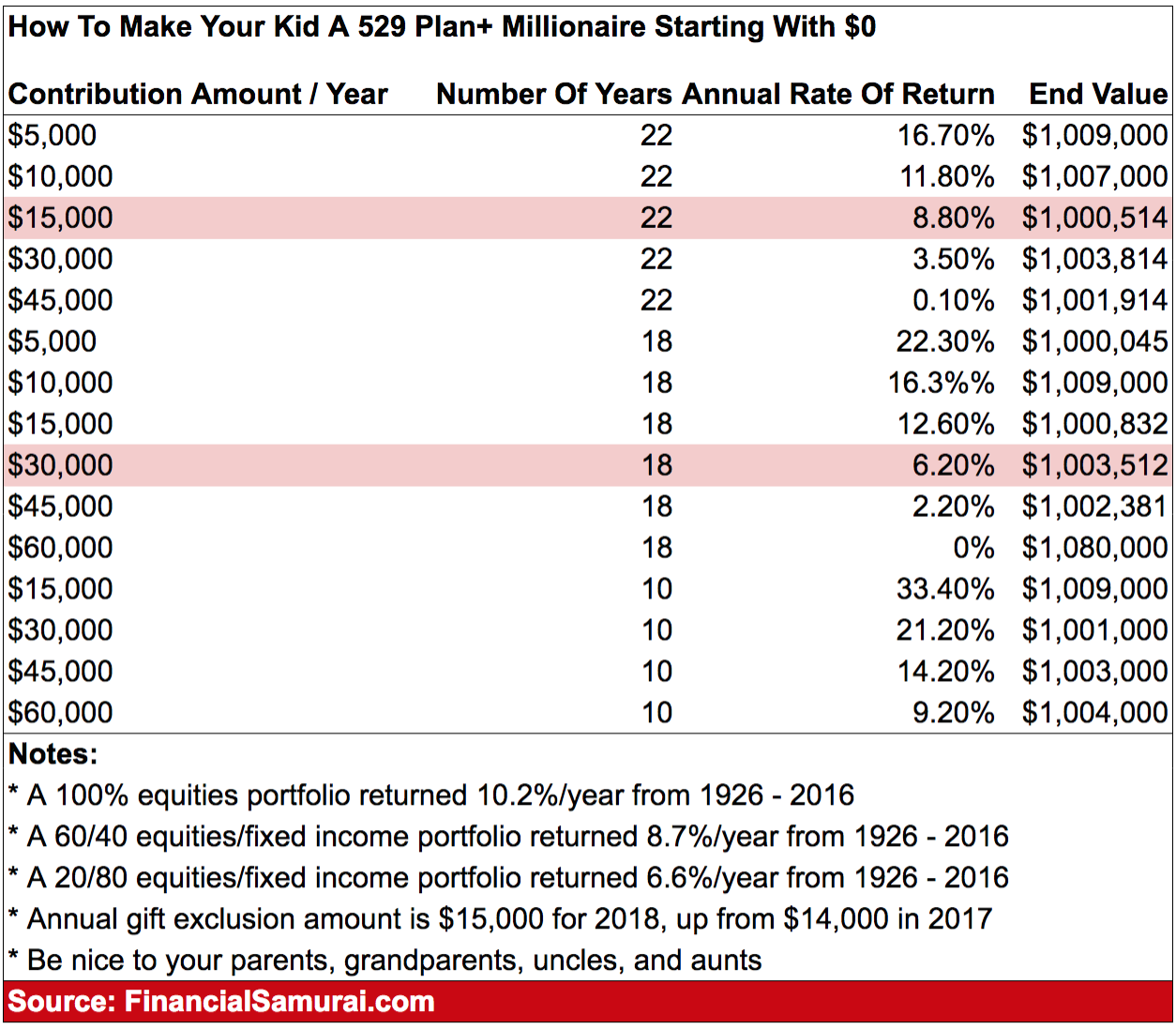

529 Plan Contribution Limits How to plan, 529 plan, 529 college, Maximum aggregate plan contribution limits range from $235,000 to $529,000 (depending on the state), but such limits generally do not apply across states. Unlike retirement accounts, the irs does not impose annual contribution limits on 529 plans.

529 Plan Maximum Contribution Limits By State Forbes Advisor, In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor. Instead, limits are based on aggregate.

The Tax Benefits and Contribution Limits of a 529 Account YouTube, What is a 529 savings plan?. The irs views contributions to 529 plans as gifts.

529 Plan Maximum Contributions YouTube, In 2024, the annual 529 plan contribution limit rises to $18,000 per contributor. 529 plans have high contribution limits,.

529 Plan Contribution Limits Rise In 2023 YouTube, In 2023, you can contribute up to $17,000 to a 529 plan ($34,000 as a married couple filing jointly) and qualify for the annual gift tax exclusion, which lets you. Instead, limits are based on aggregate.

529 Coverdell Comparison Charts, In 2024, individuals can gift up to. Each state sets its own annual contribution limit for 529 plans.

529 Yearly Contribution Limit 2025. When considering 529 contribution limits, remember the annual gift tax exclusion. In 2024, you can give up to. In 2024, you can give up to. 529 plans do not have an annual contribution limit. These Limits Typically Range From $300,000 To $500,000, But Some States May Impose. To be eligible…