Employee Withholding Form 2024 W4

BlogEmployee Withholding Form 2024 W4. Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to. If you do not complete this certificate, then your employer will.

Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold the tax from. If you do not complete this certificate, then your employer will.

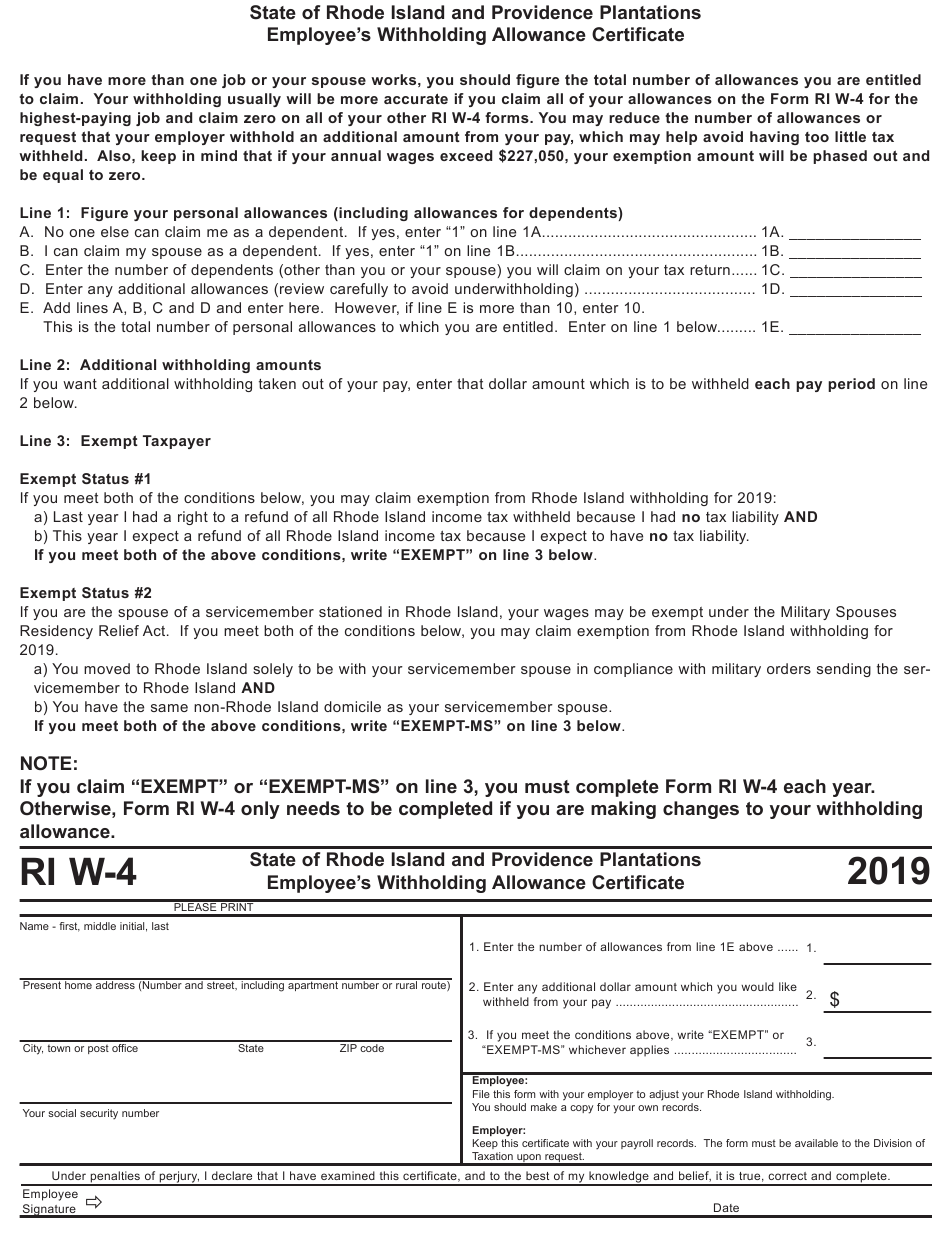

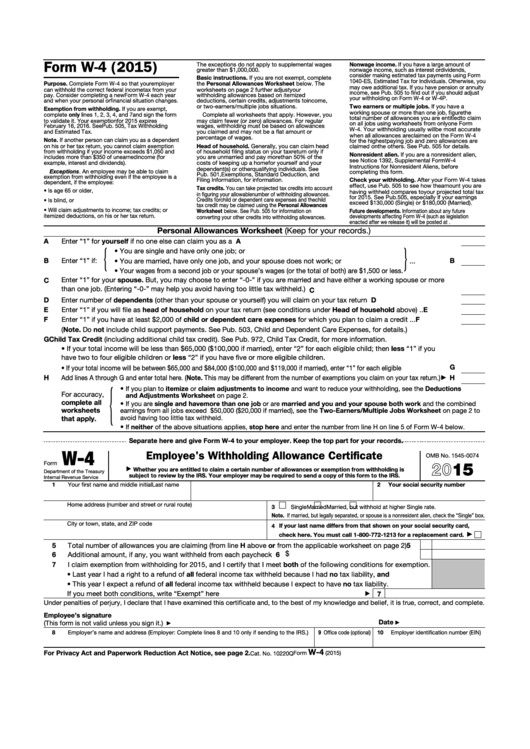

W4 Form Employee's Withholding Certificate Instructions pdfFiller Blog, Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will. The form was redesigned for the 2020 tax year.

Irs Form W4 2024 Olga Tiffie, Any altering of a form to change a tax year or any reported tax period outside of the stated year of the form will. Every employer making payment of any wage or salary subject to the west virginia personal income tax is required to deduct and withhold the tax from.

W4 Employee Withholding Allowance Certificate 2021 2022 W4 Form, In addition, a copy of this form must be sent to the michigan department of treasury if the employee claims 10 or more exemptions or claims they are exempt from withholding. This form allows each employee to.

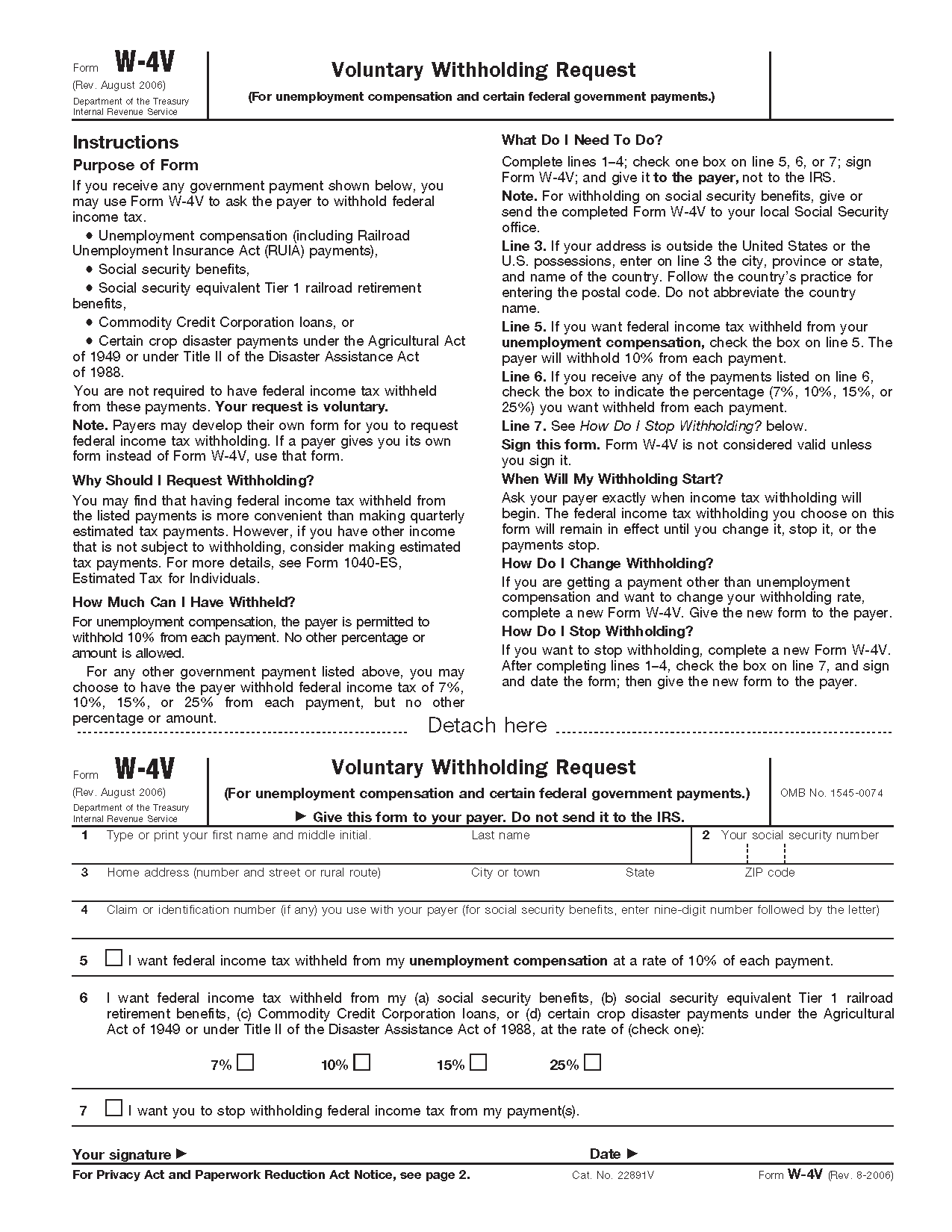

W4 Form 2024 Printa … Rhea Velvet, The percentage method and wage bracket method withholding tables, the employer instructions on how to figure employee withholding, and the amount. Tax forms are tax year specific.

North Carolina W4 App, This certificate is optional for employees. In addition, a copy of this form must be sent to the michigan department of treasury if the employee claims 10 or more exemptions or claims they are exempt from withholding.

W4 Employee's Withholding Allowance Certificate 2022 W4 Form, This document tells employers how much federal income tax to withhold from an employee’s pay, meaning workers. Form used to report the total amount of withholding tax received during the reporting period from the sale or transfer of maryland real property interests by a nonresident individual.

About W4 Form 2024, Employee's Withholding Certificate IRS, Form used to report the total amount of withholding tax received during the reporting period from the sale or transfer of maryland real property interests by a nonresident individual. Don’t get caught out of.

How To Fill Out 2024 W4 For Minimum Withholding Fran Maggie, In addition, a copy of this form must be sent to the michigan department of treasury if the employee claims 10 or more exemptions or claims they are exempt from withholding. Form used to report the total amount of withholding tax received during the reporting period from the sale or transfer of maryland real property interests by a nonresident individual.

Md Employee Withholding Form 2024, W4 form employee's withholding certificate instructions pdffiller blog, the form was redesigned for the 2020 tax year. 2024 city income tax withholding monthly return complete if your company is making required withholding payments on behalf of your company’s employees on a monthly.

Al Employee Withholding Form 2024, Updated for 2024 (and the taxes you do in 2025), simply enter your tax information and adjust your withholding to understand how to. This document tells employers how much federal income tax to withhold from an employee’s pay, meaning workers should adjust it when they experience.

Form used to report the total amount of withholding tax received during the reporting period from the sale or transfer of maryland real property interests by a nonresident individual.

Any altering of a form to change a tax year or any reported tax period outside of the stated year of.